In today’s fast-moving business environment, finance teams face mounting pressure to make faster, smarter decisions—especially when sudden changes hit their cost structure. Whether it’s a spike in raw material costs, logistics delays, or shifting customer demand, the ability to adapt quickly can make or break quarterly performance.

That’s where Fore Eye comes in. Our AI-powered financial intelligence platform lets business leaders and finance teams ask natural questions and get immediate, actionable answers—all through a simple, conversational interface.

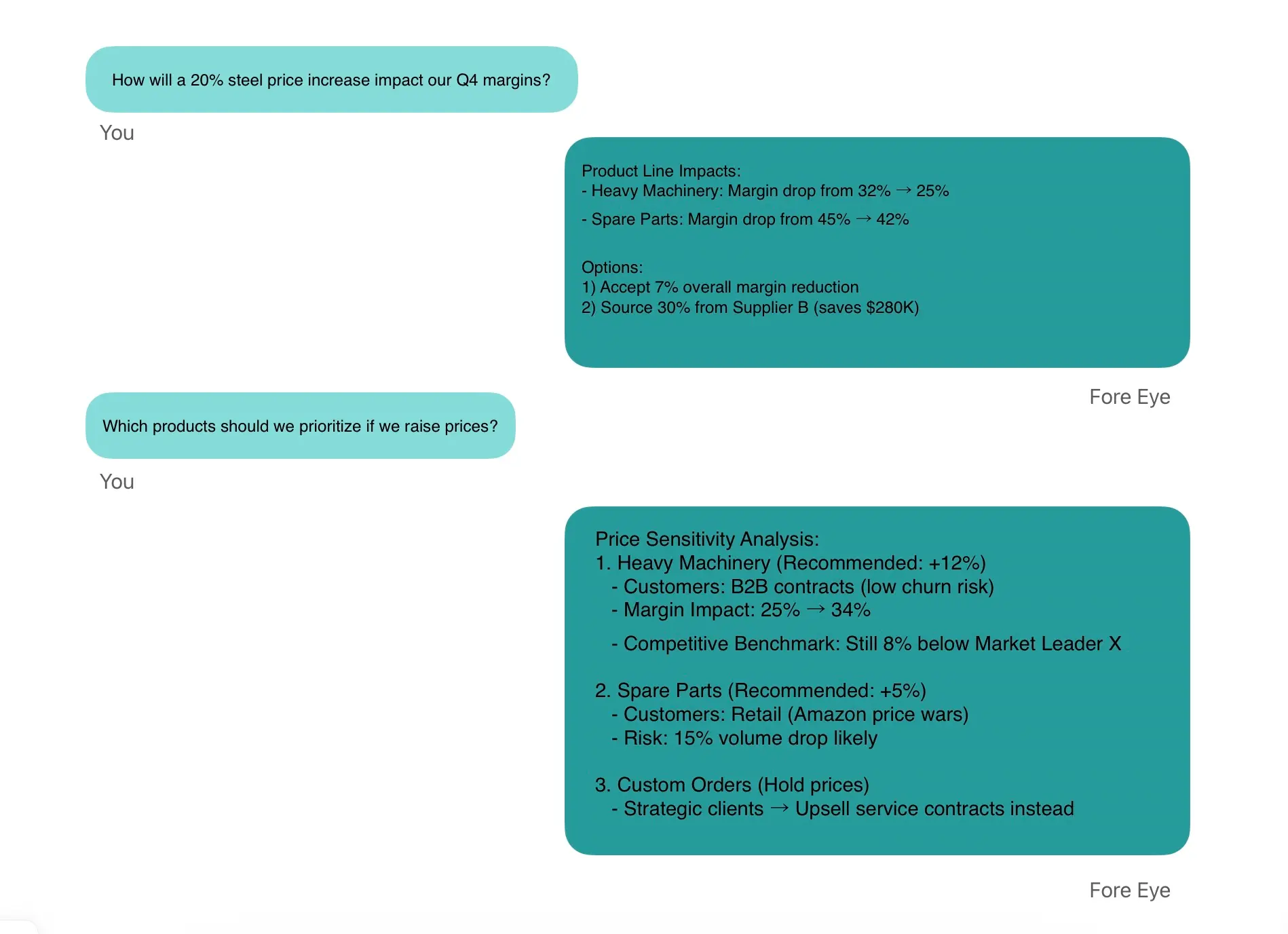

Imagine this scenario:

You: "How will a 20% increase in a key input cost impact our Q4 margins?"

Fore Eye:

Product Line Impacts:

- Heavy Machinery: Margin drops from 32% → 25%Spare Parts: Margin drops from 45% → 42%

Options:

- Accept a 7% overall margin reduction

- Source 30% from Supplier B (saving $280K)

In seconds, Fore Eye connects the dots between cost inputs, operational impact, and supplier alternatives—all within your existing data ecosystem.

You: "Which products should we prioritize if we raise prices?"

Fore Eye:

Price Sensitivity Analysis:

- Heavy Machinery (Recommended: +12%)

- Customers: B2B contracts with low churn risk

- Margin improvement: 25% → 34%

- Still priced 8% below Market Leader X

- Spare Parts (Recommended: +5%)

- Customers: Retail (high sensitivity to price changes)

- Risk: 15% volume drop likely

- Custom Orders (Hold Prices)

- Strategic clients—better to upsell service contracts instead

Fore Eye doesn’t just deliver static reports—it communicates insights the way teams think and collaborate. Below is an example of what that experience looks like in action: